I was recently accepted into a masters program in Financial Engineering with Stevens Institute of Technology. I had a meeting with my faculty advisor this afternoon (incredibly smart Dr. German Creamer) followed by a terrific presentation from the managing director of quantatitive finance for S&P (brilliant Dr. William J. Morokoff). It was a very exciting visit and I had the opportunity to engage with some of brightest people in finance today. Looking forward to more of that.

Anyway, I left my desk at about 1:30PM after a quick check on the markets. The day showed typical volatillity and I was confident that we would see a down 20 day perhaps. I left with more shorts in play. On the way in to Hoboken I participated on a conference call with a client who informed me that the DOW had just dropped 9% in a matter of 20 minutes. Wow. I did not see that coming. Not in a single session. 200-400 points would not have been a surprise. 1000 is insane.

There are lots of rumors flying about computer glitches, financial terror, etc. Bottom line, the instability of the market should now be clear to all. Sadly, I did not have a chance to operate the desk during this extremely rare event. I am not sure I would have done the right things - but I do wish I had a chance.

And finally, wow!

Cheers!

Thursday, May 6, 2010

Friday, April 9, 2010

Bollinger Bands...

The original post was too long a video for YouTube. Sorry! Anyway, big day today. Let's see what conviction the bulls have and if the Bears are ready to raid! Here is clip 1 dealing with Bollinger Bands.

Clip 2 on todays actiion (give the videos time to process on YouTube)

Clip 2 on todays actiion (give the videos time to process on YouTube)

Thursday, April 8, 2010

The Stochastic Indicator...

I noticed an entry on Tim Knight's SlopeofHope blog that the market is broke. I happen to agree. The post analyzes the weekly chart for the RUT and points out how the stochastic signal failed for the first time. I though this would be a good time to check out the stochs on the SPX.

Wednesday, April 7, 2010

Thursday, March 25, 2010

Patience or Swift Trading?

I just know that this streak is going to break in my favor - it is a matter of time. If I were a swift enough trader, I would have exited and entered positions up and down this last 12 months. Reality is that I am not swift enough. So instead on days like today, I remain patient while everyone else panics. You can feel a top in the air. The final throws off this rally are underway. Look for big selling waves into the frothy bull mania. You can see it now if you watch the blocks carefully.

While I posted, 1172 was hit. Now we see if it holds:

While I posted, 1172 was hit. Now we see if it holds:

Wednesday, March 24, 2010

Some Weakness...

This is not a day to celebrate - though it is nice to see a down day every so often. Anyway, I think we go lower tomorrow to test support at the bottom trend line. That is the test to see where we are headed. If we bounce off that line tomorrow and close higher. I will close my newest shorts. I did take my profits on my JCP and SWKS shorts today.

Tuesday, March 23, 2010

Short! Short! Short!

March madness has new meaning for me. It is absolutely amazng how over driven the market can get in either direction. I have stopped watching the market on a minute by minute basis. Primarily to preserve my sanity - but more importantly, to preserve my short positions. I did watch the market today and was so very impressed by the move up and I am now convinced that we are in for a very viscious fall. So much so that I have doubled my short position in anticipation of the move. Wow! I just can't see the market advancing much more. At best, we grind a bit higher only to shed 10% -15% in the near term. No need for deep technical analysis here.

Tuesday, March 16, 2010

1250 Bound?

Here is a quick reaction to the day. I have not been in a position to watch the markets or react to the markets due to other significant responsibilities in my business portfolio. Having said that, I am glad as I do not think I could stomach much of this in real time.

Friday, March 12, 2010

Mid-day Thoughts on SPX...

Decided to talk about a basic pattern that repeats itself often. No guarentee that I will be right, so please keep in mind it is just a mid-day observation. Trade at your own risk fellas!

Thursday, March 11, 2010

Test Video Post

I am trying out a new format for the posts - video. I am hoping this will make regular posting more efficient. This first post is really a technology test - meaning I have spent all of 5 minutes doing TA on the charts and the rest of the time resolving technical issues. Safe to say this first post will suck. Let me know what you guys think.

Thanks

BEST BET IS TO CLICK ON THE FILE NAME OR DOUBLE CLICK ON VIDEO TO LAUNCH YOUTUBE PLAYER

Thanks

BEST BET IS TO CLICK ON THE FILE NAME OR DOUBLE CLICK ON VIDEO TO LAUNCH YOUTUBE PLAYER

Wednesday, March 10, 2010

Analysis of the Hourly....

Open the hourly chart for the SPX:

The chart features include:

We are clearly traveling in an up channel that seems to be wedging out. If you compare the RSI at the prior point we touched the upper channel resistance with this last touch, you will note divergence. Now look at the Bollinger Bands. They have constricted and flattened in the last several hours of trade after being pierced to the upside. This shows participant indecision and a possible shift in price direction may occur.

One possible short term setup is to trade the channel as it presents itself. Considering how close we are to the high of the year and where we sit in the current channel, a short with a stop above yesterday's high could be profitable. A safer short would be at the breach of the lower wedge support with a tight stop after the retest of the line. Once 1035 is broken I would expect a test of the 50pMA which is closely aligned with a major support and the 38% retrace of this wave up the channel. From there, I would watch for a test of the 50% retrace level at 1117. Depending on how quickly this takes place, we may or may not, have room to fall furhter within the up channel. The lowest point in the channel that I can see is around 1113. If we break that, back to the 1085 zone.

Good luck out there!

The chart features include:

- The distinct up channel with Red Upper Trend Line Resistance and the Green Lower Trend Line Support.

- The Green Lower Wedge Support line

- A Fib Grid from the last touch of support to the recent touch of resistance

- Several yellow support levels each labeled for clarity

- 20p MA in Pink

- 50p MA in Baby Blue

We are clearly traveling in an up channel that seems to be wedging out. If you compare the RSI at the prior point we touched the upper channel resistance with this last touch, you will note divergence. Now look at the Bollinger Bands. They have constricted and flattened in the last several hours of trade after being pierced to the upside. This shows participant indecision and a possible shift in price direction may occur.

One possible short term setup is to trade the channel as it presents itself. Considering how close we are to the high of the year and where we sit in the current channel, a short with a stop above yesterday's high could be profitable. A safer short would be at the breach of the lower wedge support with a tight stop after the retest of the line. Once 1035 is broken I would expect a test of the 50pMA which is closely aligned with a major support and the 38% retrace of this wave up the channel. From there, I would watch for a test of the 50% retrace level at 1117. Depending on how quickly this takes place, we may or may not, have room to fall furhter within the up channel. The lowest point in the channel that I can see is around 1113. If we break that, back to the 1085 zone.

Good luck out there!

Monday, March 8, 2010

Just a day or so away...

There are really only two scenarios with the pattern we see today. Open the ES daily chart.

We are rising in a very steep channel that has not had the chance to form distinct upper and lower trend lines. This is steep and the volume of the rise does not equate to the volume on the downside. This is a bit bearish. We may even be able to argue that price action is wedging in the last 7 sessions or so. This too is bearish.

Bottom line is that we either breach the major resistance at 1147 area or we are rejected. The consolidation today favors a run at the high for sure. It also provides a spot to pause if the first attack fails. The attacks at the high can go on safely for about 2 weeks before we run horizontally into the current lower trend line of the current up channel. At that point, bears will have a chance of taking control again. If however, price action over powers resistance then you can expect a significant rally, turbo charged with short covering. As a rule, we would project price action to extend 38% beyond the high. I calculate somewhere in the neighborhood of 1213.50 on the futures.

As I look at this chart, I see decreasing volume during this attack of the highs - however it is too early to evaluate divergence of the RSI on the daily chart. I would not be surprised to see a failure at resistance on the first attempt. Repeated failures followed by a breach of the lower trend line of the current up channel will call for a test of support at 1113. If we fail to bounce at that level and start to sink lower, it is reasonable to add to short positions. The ultimate short signal would be generated if the 1040 low is breached.

Well, there you have my current outlook.

Good luck trading!

We are rising in a very steep channel that has not had the chance to form distinct upper and lower trend lines. This is steep and the volume of the rise does not equate to the volume on the downside. This is a bit bearish. We may even be able to argue that price action is wedging in the last 7 sessions or so. This too is bearish.

Bottom line is that we either breach the major resistance at 1147 area or we are rejected. The consolidation today favors a run at the high for sure. It also provides a spot to pause if the first attack fails. The attacks at the high can go on safely for about 2 weeks before we run horizontally into the current lower trend line of the current up channel. At that point, bears will have a chance of taking control again. If however, price action over powers resistance then you can expect a significant rally, turbo charged with short covering. As a rule, we would project price action to extend 38% beyond the high. I calculate somewhere in the neighborhood of 1213.50 on the futures.

As I look at this chart, I see decreasing volume during this attack of the highs - however it is too early to evaluate divergence of the RSI on the daily chart. I would not be surprised to see a failure at resistance on the first attempt. Repeated failures followed by a breach of the lower trend line of the current up channel will call for a test of support at 1113. If we fail to bounce at that level and start to sink lower, it is reasonable to add to short positions. The ultimate short signal would be generated if the 1040 low is breached.

Well, there you have my current outlook.

Good luck trading!

Saturday, March 6, 2010

To Double Top of Not?

Despite wanting to do more TA this week, I consciously held back.

The primary reason is that price action has been painfully obvious. Perhaps everyone in the world expects a test of the 1150 highs on the SPX - as they should based on the price patterns and support levels. Open the daily chart for the SPX:

If we focus on the price action in November and December, we see that a trading range from roughly 085 to 1120 was in force. It was certainly volatile as well. We see large swings from bar to bar. This trading range represents the indecision of the market participants.

For the bears, the quick breach of support at 1120 and then 1085 - ON HIGH VOLUME - really suggested a trend reversal. That reversal had just about confirmed itself on February 5th when it touched as low as 1044 before the impressive intraday turn around. You can see that candle clearly on the chart.Since touching 1044, we have been on a steady climb.

Starting on Feb 16th, we climbed back into the 085-1120 channel. Volume increased and price action rose for 5 days. There was sufficient enough support to test resistance at 1115ish. The first attempt was met by the expected overhang supply and was rejected. The rejection is seen as the two consecutive down bars on Feb 22, 23. Price action found support at 092 and then at 1088ish a couple of days later. This support was right on the 20pMA. In fact, you can see the remarkable intra-day turn around candle touch the 20pMA and rocket directly afterwards.

The cup and handle pattern is pretty bullish and as soon as we broke 1115, it was clear that a full retrace of this throwback is likely. And that is where we stand today - on the verge of completing the retrace.

The real question now is will this be a double top? We shall see. Some things to look at in the coming week are volume, RSI and price action relative to the MAs. I will note that the 20pMA remains below the 50pMA. This is a bearish indicator. Also, Price action broke out above the 50pMA several days ago and is getting a bit ahead of itself. Seems to me that we will certainly see some form of throw-back near the 1150 highs with price action tending back towards the 50pMA.

I have provided all the levels that I think are relevant and tried to illustrate the setup. I hope this is helpful.

Good luck next week!

The primary reason is that price action has been painfully obvious. Perhaps everyone in the world expects a test of the 1150 highs on the SPX - as they should based on the price patterns and support levels. Open the daily chart for the SPX:

If we focus on the price action in November and December, we see that a trading range from roughly 085 to 1120 was in force. It was certainly volatile as well. We see large swings from bar to bar. This trading range represents the indecision of the market participants.

For the bears, the quick breach of support at 1120 and then 1085 - ON HIGH VOLUME - really suggested a trend reversal. That reversal had just about confirmed itself on February 5th when it touched as low as 1044 before the impressive intraday turn around. You can see that candle clearly on the chart.Since touching 1044, we have been on a steady climb.

Starting on Feb 16th, we climbed back into the 085-1120 channel. Volume increased and price action rose for 5 days. There was sufficient enough support to test resistance at 1115ish. The first attempt was met by the expected overhang supply and was rejected. The rejection is seen as the two consecutive down bars on Feb 22, 23. Price action found support at 092 and then at 1088ish a couple of days later. This support was right on the 20pMA. In fact, you can see the remarkable intra-day turn around candle touch the 20pMA and rocket directly afterwards.

The cup and handle pattern is pretty bullish and as soon as we broke 1115, it was clear that a full retrace of this throwback is likely. And that is where we stand today - on the verge of completing the retrace.

The real question now is will this be a double top? We shall see. Some things to look at in the coming week are volume, RSI and price action relative to the MAs. I will note that the 20pMA remains below the 50pMA. This is a bearish indicator. Also, Price action broke out above the 50pMA several days ago and is getting a bit ahead of itself. Seems to me that we will certainly see some form of throw-back near the 1150 highs with price action tending back towards the 50pMA.

I have provided all the levels that I think are relevant and tried to illustrate the setup. I hope this is helpful.

Good luck next week!

Sunday, February 28, 2010

Back to Analytics

Though I have been out of pocket for about a week, it feels like a year. Traveling in the Northeast has been brutal. My schedule eases up a bit this week.

I really do not like where the major indices are sitting.

Looking at the three year daily charts for both the SPX and the DJI, we see that price action broke down below the lower support line started from the March 2009 low. This is great, but it would have been much better if price action broke down below the major resistance line that started from the highs of October 2007. Unfortunately, we instead got a bounce.

This puts us in an unknown state with respect to the last two major trends. My gut is telling me that we may see a test of the January highs in the coming week or so. That would be business as usual on low volume - and I am not threatened by the prospect. This week will tell us everything.

If instead we break down, we must violate 1020 on the SPX and 9600 on the DJI. That would setup the extension of the bear market down trend that many of us have bet on. These levels coincide quite well with the 200p MA - which we have not seen since July!

Sorry for the absence of late. I'll hopefully be much more attentive to the markets this week.

Cheers!

I really do not like where the major indices are sitting.

Looking at the three year daily charts for both the SPX and the DJI, we see that price action broke down below the lower support line started from the March 2009 low. This is great, but it would have been much better if price action broke down below the major resistance line that started from the highs of October 2007. Unfortunately, we instead got a bounce.

This puts us in an unknown state with respect to the last two major trends. My gut is telling me that we may see a test of the January highs in the coming week or so. That would be business as usual on low volume - and I am not threatened by the prospect. This week will tell us everything.

If instead we break down, we must violate 1020 on the SPX and 9600 on the DJI. That would setup the extension of the bear market down trend that many of us have bet on. These levels coincide quite well with the 200p MA - which we have not seen since July!

Sorry for the absence of late. I'll hopefully be much more attentive to the markets this week.

Cheers!

Tuesday, February 16, 2010

Into some cogestion...

I took today as an opportunity to cash in on my long hedge positions. These include all of the in-the-money February and March call options and believe it or not, I took profits on SLV.

We officially broke out of the down channel today on both SPX and DJI. We are also inside the lower portion of a congestion band that may take some time to clear. As I see it, we will either muddle along in the 1090-1110 range for next couple of weeks, or we are going to see another test of 1040 this week. The general conditions have not changed. National debt crisis in Europe is still unraveling, China is selling US dollar, FEDs need to raise rates. Dollar has cooled and is looking for support here - but will likely fall lower to the 78.900s. Finally, lots of gaps were filled today and volumes were very low going into the key 1100 area.

My traveling is extreme and I just haven't any time to post a chart. Do look at the DJI and SPX daily charts to appreciate the overhang supply that should serve as resistance short term.

Cheers!

We officially broke out of the down channel today on both SPX and DJI. We are also inside the lower portion of a congestion band that may take some time to clear. As I see it, we will either muddle along in the 1090-1110 range for next couple of weeks, or we are going to see another test of 1040 this week. The general conditions have not changed. National debt crisis in Europe is still unraveling, China is selling US dollar, FEDs need to raise rates. Dollar has cooled and is looking for support here - but will likely fall lower to the 78.900s. Finally, lots of gaps were filled today and volumes were very low going into the key 1100 area.

My traveling is extreme and I just haven't any time to post a chart. Do look at the DJI and SPX daily charts to appreciate the overhang supply that should serve as resistance short term.

Cheers!

Tuesday, February 9, 2010

Nice Tradining Day

I'll tell you, there is still a substantial amount of selling pressure in the market. The concerns in Europe are not going to easily fade. Big boys realize that this market remains very fragile and suspect to a big leg down.

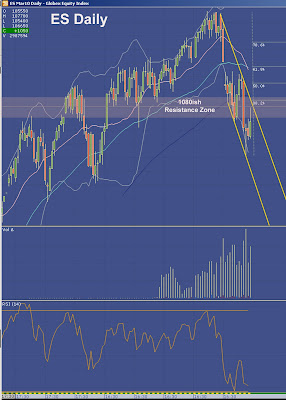

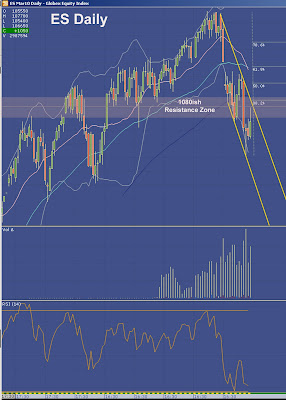

The action today was pretty much to be expected. Resistance appeared, with strength, in exactly the spots that I expected. Open the Daily of the ES:

This is a review of what I posted in the past week. Note the resistance band that I have highlighted in transparent red. The last couple of days showed indecision in the center of our down channel. Today, bulls made a run at it. Action got volatile which shows that there are real sellers waiting for these blips. Note how the price action could not reach the upper band - even on the high volume spike that we saw. It was rejected immediately and was never able to recompose. This all happened at around 1080 on the cash index. If you follow the tip of the price spike back in time, you will see how much overhang the market needs to digest. It ain't happening in one shot!

The price settled right back down at the 1070ish level - which will reveal itself as either support or resistance in the next couple of sessions.

This is really a fine trading opportunity. The strategy should be to short the blips at key resistance levels and collect your cash at the end of the rejection waves. One can do this all day and easily make 10-20 ES points in a day.

Cheers!

The action today was pretty much to be expected. Resistance appeared, with strength, in exactly the spots that I expected. Open the Daily of the ES:

This is a review of what I posted in the past week. Note the resistance band that I have highlighted in transparent red. The last couple of days showed indecision in the center of our down channel. Today, bulls made a run at it. Action got volatile which shows that there are real sellers waiting for these blips. Note how the price action could not reach the upper band - even on the high volume spike that we saw. It was rejected immediately and was never able to recompose. This all happened at around 1080 on the cash index. If you follow the tip of the price spike back in time, you will see how much overhang the market needs to digest. It ain't happening in one shot!

The price settled right back down at the 1070ish level - which will reveal itself as either support or resistance in the next couple of sessions.

This is really a fine trading opportunity. The strategy should be to short the blips at key resistance levels and collect your cash at the end of the rejection waves. One can do this all day and easily make 10-20 ES points in a day.

Cheers!

Saturday, February 6, 2010

Good Entry for SLV?

Over the years I have made a good deal of money trading SLV. Very odd considering I rarely do TA on the SLV etf. I have simply purchased at levels that I "feel" are right and sell at levels that net nice returns.

I don't wish to dwell on the physical vrs. paper arguement - at least not too much. I will say that I am going to add physical silver this month. The benefit being that physical is truly a long term investment AND in the event of a nasty social/political/economic upheaval - fiat currency may not be that valuable.

From a trading standpoint, I am accumulating SLV right now. Open the chart and I will try to explain why:

First, note the up channel bounded by the yellow trend lines. We recently broke the bottom trend line and (like the equities) have bounced back - just inside the lower line. IF we are to remain in the up channel, this is a decent entry point. IF we are breaking down and out there are some key support levels just below - which should at least temper further downside risk.

The Long Term Support Zone is highlighted in green. Follow the thin green line across to the left. You will see that this line aligns nicely with the tops of several reaction highs during the last three years. The more reaction highs, the more like the support will hold. We just touched that line this past week. Just below that green line is the 50% retrace level of the March rally. This is a common spot for reversal. These levels are very close to the $14 level. Any buys in this area I think are good ones.

What if we break below $14? Well that is not good and I would probably unload. I would do so with an eye at the $12.50 area. I choose this spot for several reasons. First, it would be a test of the major down trend line that started in 2008. If we do not bounce there - look out below. Second, it alings with the 62% retrace off the bottom. This is the last chance for a reversal. Failure there would suggest a pretty nasty future. Finally, the $12.50 level has proven to be a long term support for reaction lows over the three year period.

As you know, I am short the market. The good news is that I am only 60 S&P points out from profitability on those positions and 600 dow points away. In both cases I have some insurance that limits my loss potential through March. When looking at the true pressure in the market - currency crisis - I think SLV is a smart play. If there is going to be a currency crisis - I think GLD and SLV are going to be the ultimate safe haven play. Also, though DEBT and CURRENCY concerns are driving the current market activity - there is still industrial demand and silver has a role beyond safe haven.

That is my take on silver and why I am willing to play the long swing position for now.

I am very interested in comments on this subject.

Thanks!

I don't wish to dwell on the physical vrs. paper arguement - at least not too much. I will say that I am going to add physical silver this month. The benefit being that physical is truly a long term investment AND in the event of a nasty social/political/economic upheaval - fiat currency may not be that valuable.

From a trading standpoint, I am accumulating SLV right now. Open the chart and I will try to explain why:

First, note the up channel bounded by the yellow trend lines. We recently broke the bottom trend line and (like the equities) have bounced back - just inside the lower line. IF we are to remain in the up channel, this is a decent entry point. IF we are breaking down and out there are some key support levels just below - which should at least temper further downside risk.

The Long Term Support Zone is highlighted in green. Follow the thin green line across to the left. You will see that this line aligns nicely with the tops of several reaction highs during the last three years. The more reaction highs, the more like the support will hold. We just touched that line this past week. Just below that green line is the 50% retrace level of the March rally. This is a common spot for reversal. These levels are very close to the $14 level. Any buys in this area I think are good ones.

What if we break below $14? Well that is not good and I would probably unload. I would do so with an eye at the $12.50 area. I choose this spot for several reasons. First, it would be a test of the major down trend line that started in 2008. If we do not bounce there - look out below. Second, it alings with the 62% retrace off the bottom. This is the last chance for a reversal. Failure there would suggest a pretty nasty future. Finally, the $12.50 level has proven to be a long term support for reaction lows over the three year period.

As you know, I am short the market. The good news is that I am only 60 S&P points out from profitability on those positions and 600 dow points away. In both cases I have some insurance that limits my loss potential through March. When looking at the true pressure in the market - currency crisis - I think SLV is a smart play. If there is going to be a currency crisis - I think GLD and SLV are going to be the ultimate safe haven play. Also, though DEBT and CURRENCY concerns are driving the current market activity - there is still industrial demand and silver has a role beyond safe haven.

That is my take on silver and why I am willing to play the long swing position for now.

I am very interested in comments on this subject.

Thanks!

Friday, February 5, 2010

Seems to be channel after all!

Another impressive day. The best part of the day was of course the low. As I said yesterday, we were diverging and a bounce would be expected. I'm glad the bounce came where it did. It confirms that we have a legit down channel and not a falling wedge. Open the hourly chart for the ES:

The gold channel is the channel I drew on yesterdays daily chart, only here it is illustrated on the hourly chart. Note how if we did not touch bottom near 042 this would be more of a wedge. The reaction off the bottom was strong indeed, and predictable from the divergene in the RSI that started to develop late yesterday.

I have labeled some important levels. First, we will have some resitance to on monday morning in the 068 area. This may or may not prove to be significant. I suspect it may not hold a lid on the reaction wave that started today. If it does not hold, we can expect a run to the 082 area - which now the 38% retrace level back towards the high. It is also a major resistance level going forward and I do not think it will be so easy to get by. Depending on the timing of the price action, it may align perfectly with the upper trend line of the down channel. There is recent supply and historic supply at this level which will likely take time to exhaust (see yesterays daily graph for a view of the historic supply).

Beyond the 38% level and the upper trend line of the down channel, we have the 50% at 094ish and 62% at 1106ish retrace levels. Both are in zones of recent resistance. I just don't see a break out happening just yet. We are in a "no mans" land right now and true support is down around 1020.

We shall see. I hope everyone made some $change$ today.

Have a great weekend.

The gold channel is the channel I drew on yesterdays daily chart, only here it is illustrated on the hourly chart. Note how if we did not touch bottom near 042 this would be more of a wedge. The reaction off the bottom was strong indeed, and predictable from the divergene in the RSI that started to develop late yesterday.

I have labeled some important levels. First, we will have some resitance to on monday morning in the 068 area. This may or may not prove to be significant. I suspect it may not hold a lid on the reaction wave that started today. If it does not hold, we can expect a run to the 082 area - which now the 38% retrace level back towards the high. It is also a major resistance level going forward and I do not think it will be so easy to get by. Depending on the timing of the price action, it may align perfectly with the upper trend line of the down channel. There is recent supply and historic supply at this level which will likely take time to exhaust (see yesterays daily graph for a view of the historic supply).

Beyond the 38% level and the upper trend line of the down channel, we have the 50% at 094ish and 62% at 1106ish retrace levels. Both are in zones of recent resistance. I just don't see a break out happening just yet. We are in a "no mans" land right now and true support is down around 1020.

We shall see. I hope everyone made some $change$ today.

Have a great weekend.

Thursday, February 4, 2010

A touch of panic out there...

This has been quite a brutal selloff. This is the worst day in a long time for the S&P and the DOW. It is bringing back memories for many folks who thought the rough seas were a thing of the past. Frankly, I am amazed at how fast the market gives back months of gains. Let this be a lesson for the invincible bull.

I said that today was very, very important. Last night, I explained how we were right at the 38% retracement level of the down leg that started this correction. That was 1100. I stated that rejection here would bring a retest of the lows for the year. We got the retest, and then some...

Why is this so darn important? Well it converts a major support level to a major resistance level going forward. Open the following ES chart to see what I mean:

Looking at the Daily chart we see that the 1081 ES (futures) level is now the source of a fair amount of overhang. We traveled a full 20 points beyond to 1060 today and closed at our lows. It is going to take quite a bit of enthusiasm to rally back the 20 points just to get back to the overhang supply. The longer it takes to return to the 1080 level, the enthusiastic the selling of supply will be when we arrive.

You'll notice that we are paused on 1062 - which is our current support level. It corresponds to an old reaction high that occured well before the holiday rally. That reaction high is what supported the futures market with the Dubai scare. We have breached that low already and I suspect the futures are headed all the way to 1022. Why? Take our closing price level and scan back in time on the chart to find where we intersect. First you see dubai low then you see the middle of that very significant rally leg just 15 days earlier. Now locate the base of that very significant rally leg. You get 1022. That is our next target if this trend continues.

Speaking of trends, I think we have an official down channel here. I have illustrated the channel with yellow upper and lower trend lines. This is one heck of a sharp channel with a width of 50 points. Note how today we broke through the lower trend line of the prior up channel. I highlighted that break at the mid-point of today's price action. This was the moment of truth for me, and I am now comfortable that we will not be making new highs anytime soon.

One thing to watch is the major divergence on the 15 minute chart formed between price action and RSI. Most of the day was spent diverging. Look how oversold the condition has gotten. The key is that though we continued to make lower lows, the RSI has risen. We popped out of the oversold condition at the end of the day - yet we continued to make a new low. This is telling me that we are oversold and again price action must either pause or bounce a bit. I'll be watching this carefully. If we pause/bounce, the key is to quickly resume the down move until we touch the lower trend line of the down channel. If we do not, we start to form a falling wedge.

That is the quick review for the day.

Good luck out there!

I said that today was very, very important. Last night, I explained how we were right at the 38% retracement level of the down leg that started this correction. That was 1100. I stated that rejection here would bring a retest of the lows for the year. We got the retest, and then some...

Why is this so darn important? Well it converts a major support level to a major resistance level going forward. Open the following ES chart to see what I mean:

Looking at the Daily chart we see that the 1081 ES (futures) level is now the source of a fair amount of overhang. We traveled a full 20 points beyond to 1060 today and closed at our lows. It is going to take quite a bit of enthusiasm to rally back the 20 points just to get back to the overhang supply. The longer it takes to return to the 1080 level, the enthusiastic the selling of supply will be when we arrive.

You'll notice that we are paused on 1062 - which is our current support level. It corresponds to an old reaction high that occured well before the holiday rally. That reaction high is what supported the futures market with the Dubai scare. We have breached that low already and I suspect the futures are headed all the way to 1022. Why? Take our closing price level and scan back in time on the chart to find where we intersect. First you see dubai low then you see the middle of that very significant rally leg just 15 days earlier. Now locate the base of that very significant rally leg. You get 1022. That is our next target if this trend continues.

Speaking of trends, I think we have an official down channel here. I have illustrated the channel with yellow upper and lower trend lines. This is one heck of a sharp channel with a width of 50 points. Note how today we broke through the lower trend line of the prior up channel. I highlighted that break at the mid-point of today's price action. This was the moment of truth for me, and I am now comfortable that we will not be making new highs anytime soon.

One thing to watch is the major divergence on the 15 minute chart formed between price action and RSI. Most of the day was spent diverging. Look how oversold the condition has gotten. The key is that though we continued to make lower lows, the RSI has risen. We popped out of the oversold condition at the end of the day - yet we continued to make a new low. This is telling me that we are oversold and again price action must either pause or bounce a bit. I'll be watching this carefully. If we pause/bounce, the key is to quickly resume the down move until we touch the lower trend line of the down channel. If we do not, we start to form a falling wedge.

That is the quick review for the day.

Good luck out there!

Wednesday, February 3, 2010

Initial Thoughts...

As you all have kindly noted, I have been MIA for a number of sessions. All for good reason, but MIA none the less.

I once posted about how important it is to feel the pulse of the market and try to trade with it when possible. There is also a danger with being too close to the price action. These last few days I have only observed from afar, and I think that is helpful.

My first instinct is to try and figure out if we are dealing with a true reversal or simply a throwback. Objectively, I can not say that I see evidence of a reversal pattern. Can you? I mean give me something here. A head and shoulders? A double top? Triple top? Broadening top? Anything! I see nothing. That kinda sucks because I sure would like to have a reversal.

In the absence of a topping formation, what else can see from the 5000 yard line? You may remember this channel on the 3 yr weekly chart of the S&P.

It was tracking all the way until the Lehman collapse. We broke right down, bounced to a bottom of 666 and eventually came up to test and re-enter the channel right around the 980ish area. That re-entry was the neckline of the very large inverted head and shoulder bottom. It is also the "break-out" point for the rally up to 1150.

Note how the rally reached the top trend line, drifted along and then broke out above during the holidays. The unfortunate situation is as follows. Whenever you get a break out from a channel, price action almost invariably throws back to test the upper trend line of the channel before forging ahead. I think that is exactly what we see happening.

IF we would have re-entered this channel - then we would be able to celebrate our bear positions. However, we did not re-enter. In fact, we seem to be bouncing off the line and we could very well see the rally resume. This is sad, but we have to consider the possibility.

Right now, we have to watch 3 important resistance levels. They are 1100, 1110ish, and 1120ish and are indicated on this 15 minute chart.

They are the 38%, 50% and 62%fib retrace levels associated with the major down thrust from this year's high of 1150.

If 1120 does not hold, it is my belief that we will see new highs on the year. If, we see a strong selling session after CSCO's big beat and aggressive forecast - look for re-entry into the broad weekly channel.

Good luck everyone!

Cheers.

I once posted about how important it is to feel the pulse of the market and try to trade with it when possible. There is also a danger with being too close to the price action. These last few days I have only observed from afar, and I think that is helpful.

My first instinct is to try and figure out if we are dealing with a true reversal or simply a throwback. Objectively, I can not say that I see evidence of a reversal pattern. Can you? I mean give me something here. A head and shoulders? A double top? Triple top? Broadening top? Anything! I see nothing. That kinda sucks because I sure would like to have a reversal.

In the absence of a topping formation, what else can see from the 5000 yard line? You may remember this channel on the 3 yr weekly chart of the S&P.

It was tracking all the way until the Lehman collapse. We broke right down, bounced to a bottom of 666 and eventually came up to test and re-enter the channel right around the 980ish area. That re-entry was the neckline of the very large inverted head and shoulder bottom. It is also the "break-out" point for the rally up to 1150.

Note how the rally reached the top trend line, drifted along and then broke out above during the holidays. The unfortunate situation is as follows. Whenever you get a break out from a channel, price action almost invariably throws back to test the upper trend line of the channel before forging ahead. I think that is exactly what we see happening.

IF we would have re-entered this channel - then we would be able to celebrate our bear positions. However, we did not re-enter. In fact, we seem to be bouncing off the line and we could very well see the rally resume. This is sad, but we have to consider the possibility.

Right now, we have to watch 3 important resistance levels. They are 1100, 1110ish, and 1120ish and are indicated on this 15 minute chart.

They are the 38%, 50% and 62%fib retrace levels associated with the major down thrust from this year's high of 1150.

If 1120 does not hold, it is my belief that we will see new highs on the year. If, we see a strong selling session after CSCO's big beat and aggressive forecast - look for re-entry into the broad weekly channel.

Good luck everyone!

Cheers.

Sunday, January 31, 2010

Bounce appears over due...

Funny how the market is heading in a direction that my positions favor and I can't help but see signals that indicate that it is about to turn against me any moment.

I must say that the price action has been ugly. Looking at the hourly, daily, weekly, and the monthly - I'd say we are having either a strong correction or the pre-amble to a major break. The pull back is simply not "orderly". I don't see a channel with parallel top and bottom trend lines. I just see a lot of weakness.

Open the hourly.

Once we broke 1130 it was pretty much a free fall to 1090. Support at 1090 failed at the third test bounced only once off of the famous 1080 level. The hourly sticks tell me that this might get even worse. Look at how the bottom bollinger band never had the chance to flatten - it is now opening further suggesting further down slide in price. The 20p and 50p MAs are sloping down with some fair aggression and there seems to be some strong selling along a single top trend line that has been tested several times since the start of this decline.

At the same time, I see a significant RSI divergence where with each reaction low the corresponding reaction low in the RSI is climbing. This explains why we see these recent mini-rallies. However, these mini rallies just don't have the legs needed to overcome the significant selling pressure. For this reason, I can't say that we'll get that bounce just yet - though it would not surprise me.

Another thing that bothers me is that I can't say for sure that I see a completed EWT. I thought that wave 3 was completed at 1090 with wave 4 being the pullback to 1100ish. I expected the final capitulation to take us in a fairly straight line down to 1080ish. We kind of got that, but it took two bounces at 1090ish before we broke and touched 1080. At that point we see another mini rally intraday that took us near 1100 (yet lower than the prior reaction high). From there we see this progression of lower lows and lower highs with another sharp drop to end the day on Friday.

This is a tough one to call. When I look at the Daily chart, I have every reason to expect a trip to 1030 in the coming week or so. Regardless, there will be a bounce at some point soon. The resistance levels seem to be 1090 and then 1130. You know it is a bounce when price action cracks above the top trend line. Until then, we are headed lower and this entire move may simply be wave 1 of a much larger EWT that could take us much lower indeed.

It is good to be back, though this week is again full of travel.

Love to hear peoples thoughts on the market - especially the Thursday and Friday sessions - as I had zero time to monitor the action. As a side note, my company won an award from Microsoft for the "Most Technically Innovative Solution" at the NYC BizSpark event. Got a trophy for the effort.

Looking forward to catching up!

I must say that the price action has been ugly. Looking at the hourly, daily, weekly, and the monthly - I'd say we are having either a strong correction or the pre-amble to a major break. The pull back is simply not "orderly". I don't see a channel with parallel top and bottom trend lines. I just see a lot of weakness.

Open the hourly.

Once we broke 1130 it was pretty much a free fall to 1090. Support at 1090 failed at the third test bounced only once off of the famous 1080 level. The hourly sticks tell me that this might get even worse. Look at how the bottom bollinger band never had the chance to flatten - it is now opening further suggesting further down slide in price. The 20p and 50p MAs are sloping down with some fair aggression and there seems to be some strong selling along a single top trend line that has been tested several times since the start of this decline.

At the same time, I see a significant RSI divergence where with each reaction low the corresponding reaction low in the RSI is climbing. This explains why we see these recent mini-rallies. However, these mini rallies just don't have the legs needed to overcome the significant selling pressure. For this reason, I can't say that we'll get that bounce just yet - though it would not surprise me.

Another thing that bothers me is that I can't say for sure that I see a completed EWT. I thought that wave 3 was completed at 1090 with wave 4 being the pullback to 1100ish. I expected the final capitulation to take us in a fairly straight line down to 1080ish. We kind of got that, but it took two bounces at 1090ish before we broke and touched 1080. At that point we see another mini rally intraday that took us near 1100 (yet lower than the prior reaction high). From there we see this progression of lower lows and lower highs with another sharp drop to end the day on Friday.

This is a tough one to call. When I look at the Daily chart, I have every reason to expect a trip to 1030 in the coming week or so. Regardless, there will be a bounce at some point soon. The resistance levels seem to be 1090 and then 1130. You know it is a bounce when price action cracks above the top trend line. Until then, we are headed lower and this entire move may simply be wave 1 of a much larger EWT that could take us much lower indeed.

It is good to be back, though this week is again full of travel.

Love to hear peoples thoughts on the market - especially the Thursday and Friday sessions - as I had zero time to monitor the action. As a side note, my company won an award from Microsoft for the "Most Technically Innovative Solution" at the NYC BizSpark event. Got a trophy for the effort.

Looking forward to catching up!

Wednesday, January 27, 2010

Desk Issues Resolved...

Sorry the posts have not been coming. My desk issues are resolved. There was a conflict between my firewall and the trading platform that resulted in heavy traffic to my brokers network - causing them to block my IP address. Unfortunately, this impacted my ability to work the ES contracts.

We will probably get a bit of a bounce from here, and the tests will be first at 1100 then at 1115ish. I am actually hoping that we close in the 1110 range towards the end of the month, as I have a small butterfly spread around the 1080 - 11140 range. I think the best thing to happen for the bear camp is a battle in this range, with a downside victory.

My business calls for travel during the next two days, which means I will be inactive. I expect to resume analysis this weekend. I will be checking in on the markets from time to time and probably posting - certailing monitoring HMS blog and others.

Good luck out there!

We will probably get a bit of a bounce from here, and the tests will be first at 1100 then at 1115ish. I am actually hoping that we close in the 1110 range towards the end of the month, as I have a small butterfly spread around the 1080 - 11140 range. I think the best thing to happen for the bear camp is a battle in this range, with a downside victory.

My business calls for travel during the next two days, which means I will be inactive. I expect to resume analysis this weekend. I will be checking in on the markets from time to time and probably posting - certailing monitoring HMS blog and others.

Good luck out there!

Monday, January 25, 2010

Desk Issues...

There is nothing I hate more than technical issues with the trading desk. I really need some sleep tonight, but after installing my CA Internet Security Suite, my futures trading platform is DOWN. Last time this happened it took almost 48 non-stop hours working with technical support teams all across the globe to get it fixed. Great...

I really wanted to study the trend lines on the ES and YM tonight. So I am gonna have to work through this problem. Thankfully, I am flat overnight. But what if I weren't? Can you imagine having a 5, 10, or 20 contract position on the ES and not be in a position to monitor each tick? Frankly, I don't think I could handle 1 contract with zero visibility. I am a very visual trader - perhaps to my detriment - but I must watch each tick up, down, sideways, or gap. I need to be able to judge a head fake from a breakout. A high risk scenario from a low risk scenario - all from the live charts.

Anyway, price action moved as I thought and we did not get the significant pullback that the world expected. If you read my last post yesterday, you will see that the pullback zone was not reached and judging from the mixed trading on AAPL and TXN in the after hours, I think we'll get some weakness in the morning. Perhaps we'll get that final wave v in the EWT that I presented on the hourly chart.

There will eventually be a bounce and I suspect it may even reach that Major Short line near 1130. But I am as sure as I can be that the sellers are in control for now and the general conditions in the market are shifting.

Cheers!

I really wanted to study the trend lines on the ES and YM tonight. So I am gonna have to work through this problem. Thankfully, I am flat overnight. But what if I weren't? Can you imagine having a 5, 10, or 20 contract position on the ES and not be in a position to monitor each tick? Frankly, I don't think I could handle 1 contract with zero visibility. I am a very visual trader - perhaps to my detriment - but I must watch each tick up, down, sideways, or gap. I need to be able to judge a head fake from a breakout. A high risk scenario from a low risk scenario - all from the live charts.

Anyway, price action moved as I thought and we did not get the significant pullback that the world expected. If you read my last post yesterday, you will see that the pullback zone was not reached and judging from the mixed trading on AAPL and TXN in the after hours, I think we'll get some weakness in the morning. Perhaps we'll get that final wave v in the EWT that I presented on the hourly chart.

There will eventually be a bounce and I suspect it may even reach that Major Short line near 1130. But I am as sure as I can be that the sellers are in control for now and the general conditions in the market are shifting.

Cheers!

Sunday, January 24, 2010

Possible SPY Setups

Earlier, I posted an analysis of the SPY using the weekly chart. I wanted to add to the analysis by looking at the SPY Daily, Hourly and 1 minute charts. Again, SPY tracks SPX, and though I generally analyze the index directly, the big volume activity of Thursday and Friday warrants a look at this ETF. It is widely held and studying it directly helps me to better understand the general market sentiment of participants.

I want to start with the Daily chart, and most of my comments will be brief.

Note that we are still within an upward channel that started in mid August. This channel is approximately 80 points wide and tends to oscillate between top and bottom trend lines every 12-15 days. Note that we have been overextended since Thanksgiving, having skipped a trip to the bottom line. With this in mind, unless we break the bottom trend line near 108 (boxed region) - we remain in an up channel. Having said that, the volume and magnitude of the price drops in the last couple of sessions should have everyone on guard. Look at the low volume that accompanied the drop on Thanksgiving. In fact, buyers edged out the sellers on that day - on very low volume. Clearly, the selling on this trip suggests a very different sentiment.

We have approximately 8-10 SPX handles to go to reach bottom. If we break this bottom channel, support will be tested at several key levels. I noted in my earlier blog that SPX 960 is a very reasonable target. If that plays out, we should drop a fib from 960 to the recent high and see what we get in terms of Fib levels. At to that what seems to be the volume driven support line and our target levels include:

The most important level of the bunch is 101.22. This is the location of the 200p MA and if price action crosses below that line, we are back into bear market territory.

Focusing on the next 10 SPX handles, open the hourly chart.

This is a very, very ugly chart and one look suggests near free fall. I can not imagine buying this security. Look at it!

Anyway, I have tried something different with this chart by incorporating some shaded regions to help explain what I am thinking. First and foremost, there are three important levels of resistance on the chart. They are:

These lines are in place because I for one will look to add short positions at these levels - if they ever materialize.

I have also indicated the trend lines for recent price action. Note that the trend represents lower highs - as sellers are in control of the market right now and they decide how high the market will rise before dumping. There is no buyer evidence in the charts at all. So, the highers order trend line connects the high of the year with the first reaction high since the selling began. Note that this trend line has yet to be validated by a second reaction high (very scary!). The second trend line follows the price action from the first reaction high on Thursday through the hourly peaks on Friday. Note that the price action is falling further and further away from this line each hours (very scary again!). These trend lines are very important for the day trader as I will discuss them in this post.

Everyone is looking for a pullback Monday or Tuesday. I hope we get one, but frankly I am afraid we might not. For me, a pullback requires that price action breaks above that lower trend line and it must break above the 110.60 line. I created an orange shaded zone where I think a pullback might land. It occupies the space bounded by the trend lines and the two short lines. I would trade with caution in this zone as a break of the top line (labeled cover line) could signal a larger pullback. If we get into the pullback zone and fail to break 111.60 I would short again and double my shorts with a subsequent break below 110.60 after the failure.

Notice the green shaded areas. Any break into these areas might be a good reason to cover and wait for the next short opportunity. That opportunity is at the Major Short line near 113. I hope this all makes sense.

Now, the final detail is in the 1 minute chart:

This simple chart shows that we are in a strong down channel. I have confirmed that the top down trend line on the hourly (cover line) carries into the 1 minute chart. It serves as our cover trigger during the next couple of sessions. I have circled a natural spot to short, which is at the top of the yellow down channel. This circle also intersects with the 200p MA, and both the 50p and 20p MA are well below this moving average, which suggests we are heading lower. If we break out of this channel, I would consider covering any ES scalps.

Bottom line is that I have no reason to call for a significant pullback in the market util we at least touch down SPX 1080ish. I am watching the futures tonight to see if there is any indication of direction. We are up 5 handles on the S&P, but it is early.

Good luck out there!

I want to start with the Daily chart, and most of my comments will be brief.

Note that we are still within an upward channel that started in mid August. This channel is approximately 80 points wide and tends to oscillate between top and bottom trend lines every 12-15 days. Note that we have been overextended since Thanksgiving, having skipped a trip to the bottom line. With this in mind, unless we break the bottom trend line near 108 (boxed region) - we remain in an up channel. Having said that, the volume and magnitude of the price drops in the last couple of sessions should have everyone on guard. Look at the low volume that accompanied the drop on Thanksgiving. In fact, buyers edged out the sellers on that day - on very low volume. Clearly, the selling on this trip suggests a very different sentiment.

We have approximately 8-10 SPX handles to go to reach bottom. If we break this bottom channel, support will be tested at several key levels. I noted in my earlier blog that SPX 960 is a very reasonable target. If that plays out, we should drop a fib from 960 to the recent high and see what we get in terms of Fib levels. At to that what seems to be the volume driven support line and our target levels include:

- The 38% retrace at 104.60 (SPX 1040ish)

- The volume support line at 102.60 (SPX 1020ish)

- The 50% retrace at 101.22 (SPX 1010ish)

- The 62% retrace at 97.82 (SPX 980ish)

The most important level of the bunch is 101.22. This is the location of the 200p MA and if price action crosses below that line, we are back into bear market territory.

Focusing on the next 10 SPX handles, open the hourly chart.

This is a very, very ugly chart and one look suggests near free fall. I can not imagine buying this security. Look at it!

Anyway, I have tried something different with this chart by incorporating some shaded regions to help explain what I am thinking. First and foremost, there are three important levels of resistance on the chart. They are:

- Major Short at 113 (Representing the SPX 1130ish)

- Short at 111.60 (Representing the SPX at 1115ish)

- Short at 110.60 (Representing the SPX at 1110ish)

These lines are in place because I for one will look to add short positions at these levels - if they ever materialize.

I have also indicated the trend lines for recent price action. Note that the trend represents lower highs - as sellers are in control of the market right now and they decide how high the market will rise before dumping. There is no buyer evidence in the charts at all. So, the highers order trend line connects the high of the year with the first reaction high since the selling began. Note that this trend line has yet to be validated by a second reaction high (very scary!). The second trend line follows the price action from the first reaction high on Thursday through the hourly peaks on Friday. Note that the price action is falling further and further away from this line each hours (very scary again!). These trend lines are very important for the day trader as I will discuss them in this post.

Everyone is looking for a pullback Monday or Tuesday. I hope we get one, but frankly I am afraid we might not. For me, a pullback requires that price action breaks above that lower trend line and it must break above the 110.60 line. I created an orange shaded zone where I think a pullback might land. It occupies the space bounded by the trend lines and the two short lines. I would trade with caution in this zone as a break of the top line (labeled cover line) could signal a larger pullback. If we get into the pullback zone and fail to break 111.60 I would short again and double my shorts with a subsequent break below 110.60 after the failure.

Notice the green shaded areas. Any break into these areas might be a good reason to cover and wait for the next short opportunity. That opportunity is at the Major Short line near 113. I hope this all makes sense.

Now, the final detail is in the 1 minute chart:

This simple chart shows that we are in a strong down channel. I have confirmed that the top down trend line on the hourly (cover line) carries into the 1 minute chart. It serves as our cover trigger during the next couple of sessions. I have circled a natural spot to short, which is at the top of the yellow down channel. This circle also intersects with the 200p MA, and both the 50p and 20p MA are well below this moving average, which suggests we are heading lower. If we break out of this channel, I would consider covering any ES scalps.

Bottom line is that I have no reason to call for a significant pullback in the market util we at least touch down SPX 1080ish. I am watching the futures tonight to see if there is any indication of direction. We are up 5 handles on the S&P, but it is early.

Good luck out there!

Saturday, January 23, 2010

This time is different...

Love that expression and how it has been used throughout the last year. However, for all the bears out there who have been disappointed by the tenacity of this rally - I think this time is different.

Normally, I use the chart of the SPX in my posts. Today I am using the SPY. The SPY tracks the SPX and it allows us to look at volume. Here is the weekly SPY candlestick chart.

Some important features include:

Let me start with volume. We had an obvious spike up in volume over the last 2 weeks. In fact, it has been 12 weeks since we've seen volume above the average volume line. This is also the first time since Lehman that we have seen volume at almost twice the average line. The observation of this spike alone should cause alarm. Going further, we see that the volume in the prior 4 weeks (holidays) was pitiful. This means that any of the price action associated with that volume is very weak and hence - those gains were erased in 2 days of trading.

Now, let's look to see what else volume can tell us. Specifically, can volume help us predict support? The answer is yes. I have highlighted a range of weeks where we last saw a steady block of volume at the 10p average level of better. I found an area where buying out-weighed selling (more green than red bars). We then look at the price action in that period and see a run from roughly 88 to 108, which corresponds to 880 to 1080 on the SPX. I am happy to say that these two levels are very familiar to me, as they served as support and resistance in the past.

Looking at this highlighted volume block, we see that the only time volume exceeded the 10p Average is on a sell. That tells me that this price action is potentially soft - especially near it's top end, which is in the 1080 range. This sets up a major test this week. If we fail, the entire run from 880 to 1080 will be under attack.

What do some of the other technical indicators tell us? Let's look to the Stochs and RSI. I usually watch the stochs, but I do not consider than very reliable during strong trending markets. As you can see, they have told us that the market is over-bought for the last 6 months. A lot of good that does! It is much better to watch for divergence in the lines and for key crosses that trigger sell or buy signals. In this case, we have our fast line (yellow) cutting sharply down through our slow line (blue). This happended in a highly over-sold state. Further, the slow line shows the first real divergence from price action. Note how the last slow line top is substantially lower than the prior top while price action continued to climb. Finally, we have a reliable stoch indication that it is time to sell - and we have plenty of room to run down. The slow line can easily travel all the way down below 30 before turning back. This is a really, really bearish condition and it can not be ignored going forward. My only concern is that I do not see a substantial divergence in the RSI and we did not reach on over-bought state. This suggests the possibility of another run at the top before collapse. Look at the entire year of 2007. Follow the RSI and stocks during that final double top.

Let's move to the fib grids. First, the main grid shows me that we have essentially met resistance at the 50% retrace level. Remember, these grids are simply approximations. We do not have to hit the price down to the decimal places. We are roughly 50% back up to the top. The 50% retrace level is famous for reversal.

Next, the moving averages. The first thing I will point out is that the 50p MA remains below the 100p and 200p MAs. This may not seem important, but keep in mind that in the last 5 years, the 50p MA has always been above both the 100p and 200p average. The 50p cross below the 100p was right around the third down impulse and the 50p cross below the 200p was right around Lehman. We remain in a bearish moving average position. I will also note that price action is sitting right on the 20p MA and looking like it is going to cross below. If it does, this will be the first time that has happend since the rally began. This is a super sell signal - SUPER SELL SIGNAL. If we cross, the 50p MA becomes the target. One concern I have is that we did not touch the 200p MA - especially since the 20p MA has crossed up through the 50p MA. It is odd for price to approach as it has and turn away without a close encounter. This too suggests the possibility of another run at the high.

Now we get to a target. I have placed a box around the target zone. The top of the box roughly corresponds to the top of the range associated with the last average volume block - which is around 1080. Will 1080 hold? I don't think so. Again, I think the top is soft based on the sell volume spikes we saw during the period. Anyone who bought into the christmas rally is exiting as fast as they can. There is a sense of panic developing and I doubt the buyers at 1080 are going to try and make a stand. Their resolve was tested many times in that period, I don't see how they could stand another round of it. Though I think 1080 will fail, it will likely give enough support for a small bounce as it also aligns with the bottom bollinger band which has only been touched one other time in this rally.

Why else do I think 1080 will fail? Because it is below the 20pMA, and if we cross it will be a first and the 50p MA is a likely next target at 960. That 50p MA happens to align perfectly with the 38% retracement level of the rally off the March 09 bottom. It is also the level at which we see the first major reaction high off the bottom. It should be the "big test". If it holds, we have a correction on our hands. If it fails, we have something more signficant.

So, I am going to concentrate on a 1080-960 targer for SPX. I do not have trade setups to offer today, but I can say that the following support levels are going to be tested:

1080

1020

960

Good luck out there!

Normally, I use the chart of the SPX in my posts. Today I am using the SPY. The SPY tracks the SPX and it allows us to look at volume. Here is the weekly SPY candlestick chart.

Some important features include:

- The Main Fib Grid from the 2007 highs

- The Seconday Fib Grid spanning the reaction off of the March 09 lows

- 20p(red), 50p(baby blue), 100p(navy blue) and 200p(white) MAs

- The Fast Stochs with RSI (in red)

- Volume with 10p Average

Let me start with volume. We had an obvious spike up in volume over the last 2 weeks. In fact, it has been 12 weeks since we've seen volume above the average volume line. This is also the first time since Lehman that we have seen volume at almost twice the average line. The observation of this spike alone should cause alarm. Going further, we see that the volume in the prior 4 weeks (holidays) was pitiful. This means that any of the price action associated with that volume is very weak and hence - those gains were erased in 2 days of trading.

Now, let's look to see what else volume can tell us. Specifically, can volume help us predict support? The answer is yes. I have highlighted a range of weeks where we last saw a steady block of volume at the 10p average level of better. I found an area where buying out-weighed selling (more green than red bars). We then look at the price action in that period and see a run from roughly 88 to 108, which corresponds to 880 to 1080 on the SPX. I am happy to say that these two levels are very familiar to me, as they served as support and resistance in the past.

Looking at this highlighted volume block, we see that the only time volume exceeded the 10p Average is on a sell. That tells me that this price action is potentially soft - especially near it's top end, which is in the 1080 range. This sets up a major test this week. If we fail, the entire run from 880 to 1080 will be under attack.

What do some of the other technical indicators tell us? Let's look to the Stochs and RSI. I usually watch the stochs, but I do not consider than very reliable during strong trending markets. As you can see, they have told us that the market is over-bought for the last 6 months. A lot of good that does! It is much better to watch for divergence in the lines and for key crosses that trigger sell or buy signals. In this case, we have our fast line (yellow) cutting sharply down through our slow line (blue). This happended in a highly over-sold state. Further, the slow line shows the first real divergence from price action. Note how the last slow line top is substantially lower than the prior top while price action continued to climb. Finally, we have a reliable stoch indication that it is time to sell - and we have plenty of room to run down. The slow line can easily travel all the way down below 30 before turning back. This is a really, really bearish condition and it can not be ignored going forward. My only concern is that I do not see a substantial divergence in the RSI and we did not reach on over-bought state. This suggests the possibility of another run at the top before collapse. Look at the entire year of 2007. Follow the RSI and stocks during that final double top.

Let's move to the fib grids. First, the main grid shows me that we have essentially met resistance at the 50% retrace level. Remember, these grids are simply approximations. We do not have to hit the price down to the decimal places. We are roughly 50% back up to the top. The 50% retrace level is famous for reversal.

Next, the moving averages. The first thing I will point out is that the 50p MA remains below the 100p and 200p MAs. This may not seem important, but keep in mind that in the last 5 years, the 50p MA has always been above both the 100p and 200p average. The 50p cross below the 100p was right around the third down impulse and the 50p cross below the 200p was right around Lehman. We remain in a bearish moving average position. I will also note that price action is sitting right on the 20p MA and looking like it is going to cross below. If it does, this will be the first time that has happend since the rally began. This is a super sell signal - SUPER SELL SIGNAL. If we cross, the 50p MA becomes the target. One concern I have is that we did not touch the 200p MA - especially since the 20p MA has crossed up through the 50p MA. It is odd for price to approach as it has and turn away without a close encounter. This too suggests the possibility of another run at the high.

Now we get to a target. I have placed a box around the target zone. The top of the box roughly corresponds to the top of the range associated with the last average volume block - which is around 1080. Will 1080 hold? I don't think so. Again, I think the top is soft based on the sell volume spikes we saw during the period. Anyone who bought into the christmas rally is exiting as fast as they can. There is a sense of panic developing and I doubt the buyers at 1080 are going to try and make a stand. Their resolve was tested many times in that period, I don't see how they could stand another round of it. Though I think 1080 will fail, it will likely give enough support for a small bounce as it also aligns with the bottom bollinger band which has only been touched one other time in this rally.

Why else do I think 1080 will fail? Because it is below the 20pMA, and if we cross it will be a first and the 50p MA is a likely next target at 960. That 50p MA happens to align perfectly with the 38% retracement level of the rally off the March 09 bottom. It is also the level at which we see the first major reaction high off the bottom. It should be the "big test". If it holds, we have a correction on our hands. If it fails, we have something more signficant.

So, I am going to concentrate on a 1080-960 targer for SPX. I do not have trade setups to offer today, but I can say that the following support levels are going to be tested:

1080

1020

960

Good luck out there!

Butterfly Spread for the Range...

I am as about as anxious as I have ever been in the market. Funny, we have a correction underway, I am short, and I am anxious. Very bizarre.

I say correction, and I mean it. We have seen the SPX correct 5% in three days. I would not be surprised to see another 5%-10% in the coming week. Assuming that the correction is eventually met with buying support, the SPX may very well trade in the 960-1040 range for a while post correction. If that is the case, how do we profit in this environment? I currently have short SPY puts at 104 which if assigned will wipe my short SPY equities position out this month. I will see a small loss from that assignment, but I will not complain. I was early and deserve to pay the tuition on that one. However, is there a way that I can make up those losses with limited risk going forward? I think so. Check out the risk graph that I put together for the SPY:

This graph is of course a traditional butterfly spread. I built it using put option spreads on the SPY with March expiration's. I could have also done it with call spreads, but since I am currently short a decent number of March 101 puts I decided to build on that position.

For those unfamiliar with this type of spread, it is formed by selling short two (2)puts at a middle strike price while simultaneously buying one (1) long put at some strike higher and one (1) long put a some price lower. The exact number of contracts is up to you but the ratio needs to be 2:1 (two middle shorts, 1 long above, 1 long below)

For my spread I chose SPY 101 as the middle short, 106 for my top long put, and 96 for my bottom long put. The total cost of this transaction for me is $3.07 and that is the maximum that I can lose. (My cost is about $0.40 higher than it would normally be because I am using pre-exising short puts sold at a lower premium than they are being traded at today). This max loss point occurs if SPY closes below $91or above $111 on March 20th. For this to happen, either the correction needs to run very deep without finding support - which means we have more than a correction - or the market rallies again - which is hard for me to believe.

My profit will range with this spread if spy is between $94 and $108 by March expiration. Any close of the SPX in the 140 point range of 940 to 1080 will produce profit for me in March. The maximum profit potential is $6.93 if March closes with the SPX at 1010. The fall off in profits from this middle max is linear in both directions (SPX above 1010 or below 1010). I would double my money if the SPX closes between 970 and 1050. I think it is a good risk reward profile.

I am contemplating the same for DIA. We have seen the DJI correct a similar 5% in three days with the real possibility of 5% to 10% more. That would put the DJI down in the 9000-9600 range while it finds support.

Here is that risk graph I am considering:

For my spread I chose DIA 96 as the middle short, 106 for my top long put, and 86 for my bottom long put. The total cost of this transaction for me is $3.67 and that is the maximum that I can lose. (My cost is about $0.40 higher than it would normally be because I am using pre-exising short puts sold at a lower premium than they are being traded at today). This max loss point occurs if DIA closes below $86or above $106 on March 20th.

My profit range with this spread is $89.50 to $102.50. Any close of the DJI in the 1300 point range of 8950 to 10250 will produce profit for me in March. The maximum profit potential is $6.33 per share if March closes with the DJI at 9600. The fall off in profits from this middle max is linear in both directions (DJI above 9600 or below 9600). I would more than double my money if the DJI closes between 9350 and 9850.

Let me know what you think of the ranges - I think they are correct.

Cheers.

I say correction, and I mean it. We have seen the SPX correct 5% in three days. I would not be surprised to see another 5%-10% in the coming week. Assuming that the correction is eventually met with buying support, the SPX may very well trade in the 960-1040 range for a while post correction. If that is the case, how do we profit in this environment? I currently have short SPY puts at 104 which if assigned will wipe my short SPY equities position out this month. I will see a small loss from that assignment, but I will not complain. I was early and deserve to pay the tuition on that one. However, is there a way that I can make up those losses with limited risk going forward? I think so. Check out the risk graph that I put together for the SPY: