So, I ranted again last night. It felt good and I now have a great deal of confidence in my positions. I recently said that gut is important but technical analysis needs to confirm. I have also said that when you find price action becoming erratic and try to validate your positions in higher time frames. So with that in mind let's really step back and examine the 10yr weekly CLOSING LINE chart of the SPX:

First a word about the time frame. We live in a sound byte world dominated by short term trading and short term influences. I like to compare market action to the ocean. We are swimmers at the shore line, judging the waves as they come in. Looking for good ones to ride. The majority of swimmers spot a good one and go for it. Sometimes to find the wave is weak and not worth the energy. They find themselves in the ocean trying each successive wave with mixed results. They are singularly focused. The more experienced swimmer waits and studies the sets of waves that develop and moves into the water when he sees a good build. Riding several waves successfully and having a much better return on his investment. The seasoned swimmer is also keenly aware of the larger tides and currents in the ocean. In my younger more active years I trained for Ironman competitions - which involved ocean swimming. I am not the strongest swimmer and one day, swimming in the Atlantic off the coast of Rhode Island, I raised my head out of water to check my location against the shore. To my horror, I noticed that I had drifted 400 yards out to sea. I was alone, exhausted and caught in a very dangerous situation. You see the ocean itself moves in and out, side to side. For the most part, you can't even feel these deep shifts. The market is just like the ocean in this regard and we have to step back and determine where it is headed. Hence the 10 year chart.

First the technical features:

1. In very light grey I have overlaid a fib grid stretching from the August 2000 high down to the October 2002 low. This was the last bull market crash and since it is the most recent, it is a point of reference freshest in the minds and algorithms of traders and quants.

2. In color, I have overlaid a grid stretching from the October 2007 high to the March 2009 low. The grids do align closely - which will help give credence to any technical conclusions that can be drawn from the past. (Note that I make no statement about the differences in the fundamental economic conditions YET!)

3. In red is one possible down channel formed following the initial reaction highs and lows of the October 2007 crash. Note how all hell broke loose in September of 2008 and we plunged out of the channel dramatically.

4. The basic moving averages are in place, including the PINK 20p MA, the BLUE 50p MA, and the WHITE 200p MA.

5. Stochs and RSI accompany the chart on the lower panel.

Let's pretend this is a one minute chart for the day. Remember, price action and technical analysis is fractal - meaning it can be applied in any time frame with the same results.

If this were a one minute graph, would you go long or short? What are your reasons?

I see a possible double top with a major rejection at the second peak. I see the reaction low off the second peak descending well below the reaction low of the first peak. If you open the 20 year chart you'll see that these two peaks and two valleys define the SPX and we are smack in the middle of the action. In fact, we recently retraced to about the 50% level of the second reaction high. This is a classic pivot point and unless we bang right through it (as we did the 38% level) we are going to experience some pause, consolidation, or reversal.

How can we be more confident about that scenario? First we look at the key trends, resistance, and support levels. An argument can be made that we are at risk of continued down trend unless the market breaks the 1280 mark. Why? A major down trend is considered reversed when a succession of lower lows is interrupted and then confirmed with a higher reaction high. Technically this happened in early June of 2009 when the SPX broke and closed above 930. But, some argue that we are simply correcting for a hyper-extended sub-wave and have re-entered the down channel that I have indicated with red trend lines. If this is true, the argument can be made that the last reaction high of importance is bound by the major down trend line and appears to be the 1280 peak - right before she snapped and eventually hit that famous 666 number. We now have to run up and surpass the 1280 reaction high and set a new reaction low that does not violate 666. At that point, we will have officially reversed. How many of you are saying "that's ridiculous!"?. If you are, think of this as a 1 minute chart. Is what I am saying so ridiculous now? No, it is actual common sense. In fact, you would probably hesitate going long until you saw a break of the top channel line and a failed retest of that very line. The only difference is time frame. It is very hard for any of us to think in terms of months or years. But that is what we must do to avoid finding ourselves out to deep sea with no chance of getting back to shore.

(A side note - I would love to do a post on the fractal phenom of relative trending and try to suggest a view that may at first seem to contradict the 3 trend DOW theory model (primary, secondary, and minor), but in fact validate it at a higher level - it is really just an academic exercise but a think a good topic)

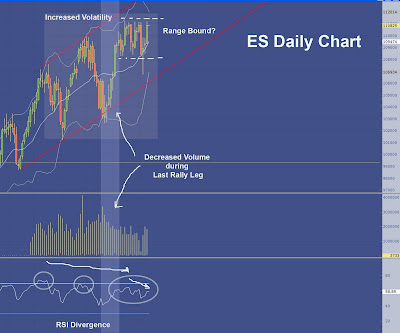

Back to the analysis. Are you still not a believer in the trend? Follow that red down trend line off the reaction highs down to our current price. We are smacking into right now. Look at the volatility over the past couple of months compared to the sharp linear rise in early months of this ascent. The tea leaves are clear - price action is hesitating. But is it simply a matter of the down trend line? The short answer is NO.

The red horizontal band across the 10 year price action is also critical. This is an area of resistance that was established from prior price consolidation during two periods. First, during the end of 2001 into early 2002 as prices tried to stabilize during the decline. Second, during early 2004 when the market was rising off of the major reaction low of September 2002. I circled the congestion of 2004 because it is most important in this analysis.

The 2004 congestion is important because, on the surface, it seems to look like what is happening today. After all, it is the 50% retracement of a violent down move. But after careful analysis, is it really the same? It is not.

Some fundamental differences exist - starting with the magnitudes and durations of the main down pulses that precede the congestion areas. The down impulse that started in 2000 lasted for 25 months. That is over two years of decline with relatively even spacing of the impulse sub waves. That two year decline included six reaction lows with the final low in October 2002. This most recent down impulse, which was triggered by much more fundamental economic concerns, has lasted only 18 months (so far) with five reaction lows - ending in March of 2009. The impulse sub waves were at first orderly, until the September 2008 panic selloff which cost market participants a full 400 points and was followed by an exhaustion sub-wave which shaved another 150 points to get us to the March low. These down impulse differ in magnitude and duration. The first lasted 26 months and cost approximately 700 handles, the most recent seems to have lasted only 18 months yet has cost roughly 900 handles.

Now let's examine each bottoming process. The 2002 bottom required approximately 8 months to confirm a reversal in May 2003 off the bottom set in September 2002. The reversal was confirmed after retracing 140 handles in that 8 month period. If the current bottom holds, the bottom will have been confirmed in a record 3 months (March to June) after retracing another record 270 points. That is twice the magnitude in half the time. Hmmm.

Finally, let's examine the magnitude and duration of the retracement levels. Starting with the 38% level. It took 14 months to retrace 275 points after the low in 2002. It took only 5 months to retrace 350 points in after the low of March 2009. That is a 30% greater magnitude gain in less that 33% of the time. Now compare the price action from the 38% retrace to the 50% retrace in both cases. In 2003 it took about 30 days to get 90% of the way and another 6 weeks to get the touch of the line. At that point we saw weakness and sinking consolidation for a full year which include retests of the 38% level. This is actually pretty normal and a healthy sign. The market rushed up through the 38% level and charged the 50% line - reaching it with only a small struggle in the final weeks. This was the early warning that things were going to cool off. Compare that to the recent run after darting to the 38% line price action has suddenly become much hindered. It has taken the world’s fastest rally almost 4 months to reach the 50% line and we still have not had a break or close of the line. Look how much the market is straining. Perhaps we now the market will take on a more normal pace. If so, we have every reason to expect consolidation between the 38% and 50% levels. That would be a 100 point range if the levels play out.

The thing is that I am having a hard time with the chart. I mean, yes it makes sense that we see resistance right now. But consolidation followed by a continued rally like we saw in 2004? Sorry, there is not a chart in the book that supports that price action. Price usually mirrors itself. If we were going to break through the 50% retrace - it would have had to be a clean shot right through to 1280. Look at the mirror side in the down pulse. Straight shot down through this range - no pause. This symmetry can be observed all on charts in all time frames, including this chart in the prior crash/recovery. The consolidation in 2004 was clearly mirrored by consolidation in the down pulse during 2001 and 2002. The lack of symmetry in the current price action raises doubt that we are going much higher and increases the probability in my calculations for a retest of the March lows. A retest of the March lows would give a proper bottom to this crash, enable price symmetry, and align more with the current economic conditions.

Looking back to 2004, why did the bull awake and drive the S&P to new highs? Was it record unemployment? Record foreclosures? The falling value of real estate? Huge deficit spending? Sinking corporate revenues? Well that is what we have going into the same technical pivot point. Again, price action is telling us something that we know to be obvious yet we see easily dismiss it all because of greed. (OK, no more rants...).

So we have a case for pause and consolidation from the fib grids, trend lines, and major resistance from past consolidation. We also have a possible issue of symmetry that suggests a possible retest of the March lows - which fundamentals seem to support as well. Can we add any further technical confirmation? Yes, the RSI.

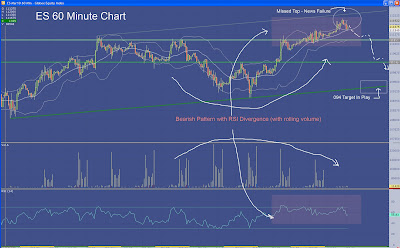

I hate to sound like a broken record on this RIS oscillator - but it is the most reliable indicator I know off and one of the few that can actually predict price movement with fair accuracy. I have highlighted key areas where we see divergence in price with the RSI. The RSI is the red line running through the stochs. (Sorry if it is not super clear). Look at every major top and bottom that is highlighted in the pale yellow vertical strips. Each area shows divergence in the RSI - major divergence. Now look at the thinner orange vertical strips to the right of the chart. You will see divergence again. Look at the last strip. The last three reaction highs are feature RSI divergence. I challenge you to find one case where an RSI divergence existed, and price did not reverse direction. There is 10 years of data for you to examine. It has never failed.

A final note is about the major difference between the MA's of these two periods. In 2003-04, the 20p MA and 50p MA had managed to travel up to meet the 200p right when price action reached the 50% retrace. This bullish event helped the market from rejecting price action and eventually move on to the long bull rally. This bullish cross was in my opinion key.

Looking at the current situation, the 20pMA and 50p MA are both well below the 200pMA. This is by definition bearish. In fact, since the 20p MA, 50p MA, and price still remain below the 200pMA - many would consider this a bear market rally. Bear market rallies usually only rally up 35% or so, however the rallie is also directly related to the magnitude and speed of the down impluse wave. This wave was very, very powerful and swift. As you can see from my prior analysis, so has been the bounce rally. We have now reached 50% retrace and the technicals are starting to play out a bit more reliably.

Another important observation is that the 20p MA has gotten way ahead of the 50p MA. In fact the averages show a 110 pt. gap - which is 10% of the index. That is outrageous! Historically, the 20p MA and the 50p MA ride much tighter and often bounce off each other periodocally. Examine the chart and you will see that during the rally off the bottom of the 2002 low, the averages never got more than 50pts away from each other. That is half the gap we see today.

I hope folks got something from this post. Preparing it certainly helped me to feel more confident about the next several weeks/months. I reiterate, this may be the very best time to be short the market.

Good luck and have a great weekend!