I see an important trend in the topping formation. Volatility is rising and we continue to set new intraday lows - in fact 3 of the last 4 sessions have made new intraday lows. We also see a very important break in trend with respect to the closing level. Today was the second session in a row which we closed lower day over day.

Granted these are not "major" reversal signs, but they are bearish and have to be considered. They reflect what I believe to be the cautious attitude that professionals and retail investors are likely to take to the September month. All of which leads me to believe that we are going to correct a bit and consolidate.

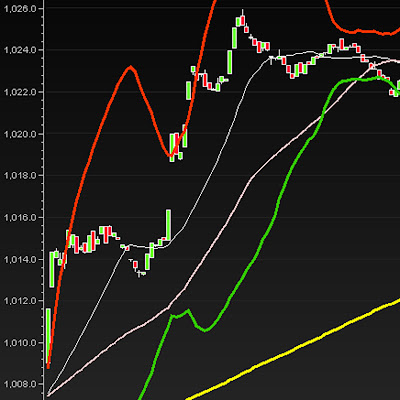

One of my favorite charts right now is the hourly for the last 20 days. Take a look in a new window:

First, you get a glimpse at the levels that affect the current price action. Check out how that little gap just so happens to line up with some fib levels to create a nasty black hole of gravity! It just sucked the price action in today and held it in check. I was really hoping to see a breakdown below the 1018 gap - looks pretty clean down to the next gravity band around 1008. Below that we are clear until some congestion in the 998-1004 band.

The other important feature in the chart is the top trend line and bottom trend line in the flag (if it is a flag!). Anyway, the price action seems to be respecting these levels and I would encourage the use of these lines in your setups. I am also watching the moving averages. Look how the 20 day just crossed down through the 50 day. Depending on the open tomorrow, these could turn down further and act as a ceiling on future price action to the upside.

As for setups - we are in a well defined range right now - certainly the 1018 to 1039 band is wide and seems to be containing price action well. We recently pierced the bottom bollinger band while the band was angling downward. So we get this sideways price action rather than a sharp reversal in price. The open is going to be critical as it will directly impact the relationship between price, the bands, moving averages and the trend lines.

The short play is getting tough here because as we move to the right, the distance between the trend line and the bottom of the gap increases - creating a less attractive point of entry. Think about it, the best short entry would be at the intersection of the bottom trend line and the bottom of the gap. That gives us the largest downside play (1015 - 1008). As we move to the right, the downside play gets constricted (because we would probably choose the lower trend line as our trigger). If you are aggressive, you can short at the break of 1015 and gamble that the trend line will break as well. This may get you the full 7 points. That is where I sit right now. Another short opportunity is to play a rejection at the top trend line - which will again be somewhere in the 1024 area if it happens early enough. Do this with a tight stop - as a break of the top trend line would be painful for you.

Speaking of the break in the top trend line - what a nice long play. That could give you a 16 point ride to the test of 1040. Not bad (unless you are short right now!).

There you have the long and the short of it - good luck!

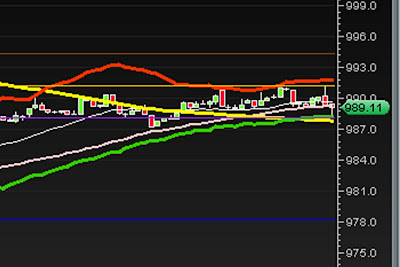

For those interested, here is a look at the chart with "price gravity bands" that I created on Saturday night - did a pretty good job of predicting today's price action!