Another moment of truth is upon us. Seems we have been here at least two other times in recent months. Will the indices reverse?

Most of my blogging relates to the SPX - as this is the index that I primarily trade. For most of my daily setups, I usually stick to correlations between the US dollar index, the ES futures contract, and the SPX itself to enter and exit trades. When I am evaluating a possible trend reversal (primary or secondary), I like to look at much more for confirmation.

Original DOW theory tells us that the DJI and the DJT need to confirm with each other. At the time that the theory was developed the averages consisted of the DOW and the Transports (Rails). If either index was showing a trend change while the other does not, you must assume that a trend change is not happening yet. In many ways this technical confirmation makes so much sense. If industrials are performing well but not the rails - what does that suggest about the true state of economic activity?

The principle of confirmation works today and can be applied to many indexes. Though transports remain valid, the COMPX is also important. Transports are more than shipping product from point A to B. Transports represents INFRASTRUCTURE for conducting business. Today, INFRASTRUCTURE includes our electronic networks - meaning technology. The COMPX tracks technology fairly well. Also, at the time of DOW theory - the US was still an industrail nation. Though this remains as a core component of our economy, we have become very much a "services" nation. As such, the SPX has become the primary index watched by market technicians and economists.

Having said all that, I think it is important to take a look at the DJI, DJT, COMP, and SPX today and see what is going on. I'll try to perform a quick assessment on each index in three time frames. Let's start with the 3yr weekly CLOSING line chart of the DOW:

Keeping it simple, we are about to test the top down trend line near A (10100ish). This happens to intersect with the top trend line of the wedge we are climbing. It also marks the intersection with top bolinger band - which has flattened more so than ever before in the last seven months. All of these technical intersections occur just below the 50% retacement from the bottom to the DOW's October high. Finally, we we are oversold and see a divergence on the stochs. All of this combined with the facts that we have not touched the 20pMA since crossing in April and we have not come back to the bottom trend line of the wedge since July - leads me to believe that the DJI still could be topping here - perhaps forming a double top. This becomes a thesis to test against other time frames and averages.

The next chart is the 100 day daily CLOSING line chart for the DOW:

On the daily chart we get a better look at the wedge that has formed over the past 100 days. Note how we break down out of the wedge last week and bounced off the 50p MA and 62% retrace level at A to test the bottom of the wedge line at B (where we are today). This is a very typical pattern in the break down of a wedge. It is also important to note the intersection of the wedge bottom trend line with the descending top trend line that has formed since hitting the highs in late October. Also note the decreasing volumes in the last three sessions and compare the volume levels with the price gains. Note the higher volumes have been on the sell side. The daily chart seems to agree with the double top thesis and a test at B is underway.

Finally, does the 3 day 3 minute graph jive?

On the 3 minute we see another wedge that has been broken. The break is labeled at point A. If we draw a new bottom trend line across the session lows of the past day and a new top trend line across the session highs over the past day - we get a triangle with an apex well outside and below the highs of the wedge. This triangle must break up or down. If it breaks up, it will reach the bottom of the wedge at B - which would be a double top moment - provided the touch was simply a retest before reversing. Any reversal would need to break C (10000ish) on volume which could start the ball rolling to the downside.

OK - what about the transports - do they support the notion of a double top? Do we see a top forming there? Before I reviewed the chart, I had expectations that we would see the transports signaling new highs. I assumed that the Buffet acquisition would have been the catalyst. Surprisingly, this is not the case. Open the daily chart of the transports:

I think we may have seen a double top already form on the transports labeled A and B. At a minimum, we seem to be rolling. Today, we are in a downtrend with the 20pMA about to cross down (or bounce off) the 50p MA. Whenever I see this happening, price action usually rises above the 20pMA and then reverses sharply making a run to the 200pMA. Key resistance will be the hypothetical down channel top line (which was made by duplicating the lower down channel line that passes through the last two lows). From a technical standpoint, this channel is not yet valid. I can go into a deep explanation, but until we see either a new high or new low on this line, it is not 100% reliable. Regardless, the chart is bearish in my estimation.

Now let's jump to the COMPX. Technology is on a cyclical tear, but when you look at the 3yr weekly chart, you have to ask "Where to next?":

The most important feature of the chart is the substantial overhang that exists from the 10 month consolidation prior to the crash. In fact, if we draw a trend line following the tops of that period and extend to our current date - we see that price action right against the line. COMPX is more volatile, so expect that the line to be tested, broke, and retested. When we study the price action around the line in the last several weeks, we see another H&S pattern with the right shoulder being formed now. Of course, until that shoulder heads south to test the neck line at 2044 again, it is not officially a pattern. Of course, we see the divergence in the stochs and like the other indices we have not touched the 20pMA since the cross in April. Unlike the other indices, we are approaching the 200pMA. Often, price action is reversed before a touch of the 200p MA - a touch is only likely if there will be a strong cross and in this case, a cross is unlikely because of the overhang.

Looking deeper at the COMPX, open the daily:

We dropped out of the up channel last week and seem to be forming a right shoulder. There are many technical resistance points that support the theory. We are at the 50% retrace level of the last down move (good reversal point), we are up against the 20p MA, the 20p MA is headed down toward the 50pMA, and price action is also approaching the down trend line formed along the last reaction highs. Don't rule out a test of the up channel bottom line near 2150. When I look at this chart and think how technology and finance led the rally - I can only believe they will lead the reversal. I will be adding to my short position near A - 2130-2150ish.

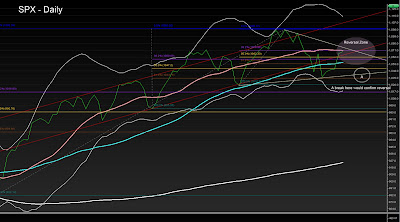

Finally, we move to the SPX, starting with the Daily chart:

Many folks use a wedge to illustrate the last 7 month rally. I acknowledge the wedge, however I have been more focused on an up channel that ahs dominated the core of the rise. That channel is in red and features many price touches and reversals along the line. Yes, we have seen the breaks above and below the line, but for the most part this channel represents the rally slope. We recenly broke the bottom trend line have come back to test the channel again. Many of us are hoping to see the right shoulder form here and a expect a substantial correction to follow.

For the shoulder to form, price action must round and then turn sharply lower. Starting with the "round" portion - we have three resistance levels/points. First, we are hitting the 20pMA during a reaction wave in a down trend. Second, we are near the top trend line that is heading down. These two forces may be enough to cause the shoulder to round over. The "sharp" portion will occur if price action crosses the 50p MA and the bottom trend line of my hypothetical triangle is breached somewhere in A (035-044 range). A firm break below 1035 (62% retrace of prior two rally legs) and a new low below near 026 will almost guarantee a reversal. Rule of thumb is to expect a reversal equal to the height of the head as measure from the neck line. That will give us a solid 70-80 points - putting the reversal somewhere down around 960. I am expecting a minimum of 990 which is the complete retracement of the last two rally legs.

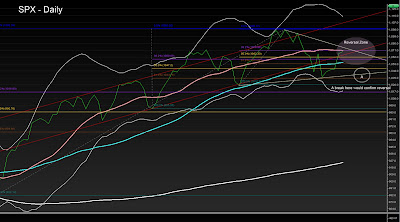

The question is, will the shoulder form? Looking finally at the 10 day 5 minute chart:

The most important feature of this chart is the rising wedge that we see leading to the close on Friday. As expected, this most recent down trend did an awesome job of layering resistance in the form of price consolidation. We rose to the congestion and as it seems, we are bending as we approach the end of the wedge. Here we see the final battle being staged. As I have watched this action I see strong forceful sell bars followed by buyers nibbling the price action higher. This feels like distribution. The key will be if we are able to break out above this congestion at say 073 and make a run up to the 080 area. Thankfully, price action will be met by congestion again so I do not think we'll see an explosive break-out. If, we roll out of this wedge and experience even 1 day of heavy selling I think we'll get our right shoulder.

Draw your own conclusions here. For me, the charts are all pointing to a bearish near term. I think the COMPX offers a particularly low risk short opportunity and will add to my position this week. I'll leave you with some common understandings regarding bear market trends:

Bear markets are characterized by three phases. First is distribution. This phase is where far sighted investors recognize that the business earnings are at peaks and it is time to unload while the getting is good. The second phase is panic. This occurs when dip buyers suddenly realize that the trend has actually changed and sell to an increasing smaller number of buyers. As a result, prices suddenly accelerate into a seemingly vertical drop. The final phase occurs when after prices have reached an apparent bottom and begin to move sideways in a range. This range often includes ups and downs which test the final resolve of those who held through the fall. Eventually, for a variety of reasons the final weak hands are broken and the selling comes to climatic end.

This bear market phenom can play out at the primary or secondary trend level. I wonder if we'll see it soon...

Good luck