As you all have kindly noted, I have been MIA for a number of sessions. All for good reason, but MIA none the less.

I once posted about how important it is to feel the pulse of the market and try to trade with it when possible. There is also a danger with being too close to the price action. These last few days I have only observed from afar, and I think that is helpful.

My first instinct is to try and figure out if we are dealing with a true reversal or simply a throwback. Objectively, I can not say that I see evidence of a reversal pattern. Can you? I mean give me something here. A head and shoulders? A double top? Triple top? Broadening top? Anything! I see nothing. That kinda sucks because I sure would like to have a reversal.

In the absence of a topping formation, what else can see from the 5000 yard line? You may remember this channel on the 3 yr weekly chart of the S&P.

It was tracking all the way until the Lehman collapse. We broke right down, bounced to a bottom of 666 and eventually came up to test and re-enter the channel right around the 980ish area. That re-entry was the neckline of the very large inverted head and shoulder bottom. It is also the "break-out" point for the rally up to 1150.

Note how the rally reached the top trend line, drifted along and then broke out above during the holidays. The unfortunate situation is as follows. Whenever you get a break out from a channel, price action almost invariably throws back to test the upper trend line of the channel before forging ahead. I think that is exactly what we see happening.

IF we would have re-entered this channel - then we would be able to celebrate our bear positions. However, we did not re-enter. In fact, we seem to be bouncing off the line and we could very well see the rally resume. This is sad, but we have to consider the possibility.

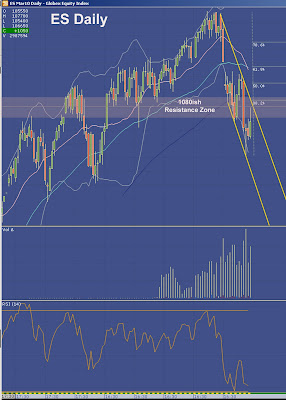

Right now, we have to watch 3 important resistance levels. They are 1100, 1110ish, and 1120ish and are indicated on this 15 minute chart.

They are the 38%, 50% and 62%fib retrace levels associated with the major down thrust from this year's high of 1150.

If 1120 does not hold, it is my belief that we will see new highs on the year. If, we see a strong selling session after CSCO's big beat and aggressive forecast - look for re-entry into the broad weekly channel.

Good luck everyone!

Cheers.